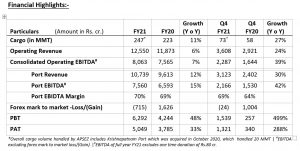

- PBT at Rs.6,292 cr. a growth of 48% and

- PAT at Rs.5,049 cr. a growth of 33% in FY21

FY21 (Y o Y)

- Handled a cargo volume of 247 MMT, registering a growth of 11%

- Container volume at 7.2 million TEUs, market share improves by 5% to 41%

- Total Revenue at Rs.12,550 cr., a growth of 6%

- Total EBIDTA at Rs.8,063 cr., registers a growth of 7%

- PBT at Rs.6,292 cr. up 48% and PAT at Rs.5,049 cr. up 33%

- Generated free cash flow^ of Rs.5,800 cr., a growth of 47%

- Net debt to EBIDTA improves to 3.3x in Mar ’21 compared to 3.4x in Sep ‘20

(Free cash flow – Cash flow from operations after adjusting for working capital changes, Capex and net interest cost)

Ahmedabad, May 4th, 2021: Adani Ports and Special Economic Zone Limited (“APSEZ”), the largest transport utility in India and a part of the diversified Adani Group today announced its operational and financial performance for the fourth quarter and year ended 31st March 2021.

M&A Highlights – FY21:

- In April ’21, APSEZ signed an agreement to acquire balance 25% stake in Krishnapatnam Port. The acquisition is expected to be completed in Q1 FY22.

- In March ’21, APSEZ also announced the acquisition of 100% stake in Gangavaram Port. The acquisition is expected to be completed in Q3 FY22.

- Upon completion of the transactions both Krishnapatnam Port and Gangavaram Port will be wholly owned subsidiaries of APSEZ.

Operational Highlights – FY21 (Y o Y)

- APSEZ outperformed the market and grew by 11%, on the back of 16% growth in container and 9% growth in dry bulk cargo. APSEZ registered a record throughput of 247 MMT and achieved a market share of 25%, a gain of 4%.

- APSEZ ports across the Indian coastline registered positive growth. While east coast ports grew by 42%, west coast ports grew by 3% outperforming the nearby major ports.

- APSEZ handled highest ever container volume of 7.2 million TEUs during the year and achieved a market share of 41%, a gain of 5%. Mundra Port continues to be the largest container handling port in India and handled 5.66 Mn TEUs which is almost nearly one million TEUs more than JNPT.

- The surge in the container growth is attributed to our strategy of partnering with top global ship liners through JVs and acquisition of container handling ports like Ennore and Krishnapatnam.

- In FY21, ten new container services were added, four at Mundra and two each at Hazira, Kattupalli & Ennore, which will add 800,000 TEUs per annum.

- Mundra port continues to be the largest commercial port in India, grew by 4% and handled a record cargo of 144 MMT, on the back of 18% growth in container volume.

- Given this performance, the gap between Mundra port and Kandla port, the second largest port has widened further. Mundra port is ahead by 23%.

- Dhamra port grew by 9% and handled a record volume of 32 MMT.

- In April ‘21 Adani Logistics Limited announced a strategic and commercial partnership with e-commerce major Flipkart, to strengthen its supply chain infrastructure.

- As part of this partnership, Adani Logistics Limited will construct a massive 534,000 sq. ft. of fulfilment centre by leveraging state-of-the-art technologies in its upcoming logistics hub in Mumbai. The centre will have the capacity to house 10 million units of sellers’ inventory at any point and will be operational by Q3 of 2022. The centre will support market access to several thousands of sellers, MSMEs and will enhance local employment for the region and create ~2500 direct jobs and thousand of indirect jobs.

Financial Highlights – FY21 (Y o Y)

Operating & Port Revenue: –

- In FY21, total Operating Revenue grew by 6% from Rs.11,873 cr. in FY20 to Rs.12,550 cr. Port revenue has increased by 12% to Rs.10,739 cr. on account of 11% growth in cargo. Revenues from the logistics business stood at Rs.958 cr.

EBITDA : –

- Increased cargo volume, operational efficiencies enabled port EBITDA to grow by 15% from Rs.6,593 cr. in FY20 to Rs.7,560 cr. in FY21.

- Port EBITDA margin for FY21 increased by 100 bps to 70% due to optimal use of resources and operating efficiency.

- Logistics business has reported an EBIDTA of Rs.226 cr. in FY21 and maintained the EBIDTA margin at 24%.

Balance Sheet and Cash flow –

- In FY21, net debt to EBIDTA was at 3.3 times and was within the guided range of 3 to 3.5 times compared to 3.4 times in Sep 2020. This is due to addition of KPCL EBITDA post consolidation.

- Free cash flow from operations after adjusting for working capital changes, Capex and net interest cost increased by 47% from Rs.3,942 cr. in FY20 to Rs.5,800 cr. in FY21 and in the process improved the free cash conversion to 72% compared to 52% in FY20.

Mr. Karan Adani, Chief Executive Officer and Whole Time Director of APSEZ said,

“FY21 has been a transformational year for APSEZ. Some of the key decisions we took this year have set the foundation for the coming decade. Our customer centric approach has yielded good result for us as our market share increased by 4% on a pan-India basis. Mundra port which is the largest commercial port in the country, this year has also become the largest container port in the country surpassing JNPT by a big leap. We have also been able to restructure our cost fundamentally and were able to demonstrate an increase in EBIDTA margin by 1% taking our port margins to 70%. On the growth side we used this time to complete four large acquisitions i.e Krishnapattanam port, Gangavaram port, Dighi port and Sarguja Rail line, taking our total portfolio to 13 ports in the country. The total value of said investment was Rs.26,000 cr. We have also been able to take another milestone step in our international journey by foryaing into container terminal in Colombo port. With these steps we are truly in the right direction to take APSEZ from a port company to a transport utility company delivering full logistics solution to our customers.

In the logistics business, we have been able to scale up and diversify our railway rolling stock business. The recent changes in the General Purpose Wagon Investment Scheme (GPWIS) of Indian railways has given opportunity to serve our bulk customers not just from ports but also from the mines. We were able to add contracts to operate 16 new rakes for transportation of raw material from the mines. FY21 has also seen shift towards e-commerce and hence a fundamental shift towards demand increasing for large format Grade A warehouses. Adani Logistics have forayed into this sector and has the vision to be the largest player in this sector in the coming 5 years. We have set our sight to build 30 million Sq.ft. of warehousing capacity in the next 5 years.

In FY21 we have also setup a new vertical of Railway track business. With the acquisition of Sarguja Rail (SRCPL) and restructuring of other railway tracks within APSEZ we have set the foundation to partner with Indian railway and invest in strategic rail lines under the PPP model. With this we have created India’s first private sector railway track asset company with a steady stream of annuity income.

In FY22, basis our internal estimates we guide for cargo volume to be in the range of 310-320 MMT, this includes 10 MMT of Gangavaram port in Q4 FY22. Consolidated revenue to be in the range of Rs.16,000 cr. to Rs.16,800 cr., Consolidate EBIDTA to be in the range of Rs.10,200 cr. to Rs.10.700 cr. and free cash flow to be in the range of Rs.5,500 cr. to Rs.6,000 cr.

With all this APSEZ is well on its course to become a truly integrated transport and logistics utility and achieve 500 MMT of cargo throughput and ROCE to be in excess of 20% by FY25.”

About Adani Ports and Special Economic Zone

Adani Ports and Special Economic Zone (APSEZ), a part of globally diversified Adani Group has evolved from a port company to Ports and Logistics Platform for India. It is the largest port developer and operator in India with 12 strategically located ports and terminals — Mundra, Dahej, Kandla and Hazira in Gujarat, Dhamra in Odisha, Mormugao in Goa, Visakhapatnam in Andhra Pradesh, and Kattupalli and Ennore in Chennai and Krishnapatnam in Andhra Pradesh — represent 24% of the country’s total port capacity, handling vast amounts of cargo from both coastal areas and the vast hinterland. The company is also developing a transshipment port at Vizhinjam, Kerala and a container Terminal in Myanmar. Our “Ports to Logistics Platform” comprising our port facilities, integrated logistics capabilities, and industrial economic zones, puts us in a unique position to benefit as India stands to benefit from an impending overhaul in global supply chains. Our vision is to be the largest ports and logistics platform in the world in the next decade. With a vision to turn carbon neutral by 2025, APSEZ was the first Indian port and third in the world to sign up for the Science-Based Targets Initiative (SBTi) committing to emission reduction targets to control global warming at 1.5°C above pre-industrial levels.