ATL reports cash profit of Rs. 1,591 Cr, up 51% yoy in H1 and Rs. 676 Cr, up 30% yoy in Q2

PBT of Rs. 778 Cr, up 33% yoy in H1 and Rs. 296 Cr, up 12% yoy in Q2

Operational Highlights H1 FY21:

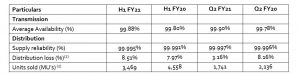

Transmission

- Robust Transmission system availability at 99.9% even during pandemic times

Distribution

- Maintained supply reliability at 99.99% (ASAI) during difficult period of Covid

- Customer adoption of digital avenues to interface with company increases manifold reaching 73.3% (e-payments as a % of total collection) in H1 FY21 from 47.2% in H1 FY20

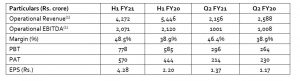

Financial Highlights H1 FY21:

- Cash Profit of Rs. 1,591 Cr, up 51% yoy

- PAT at Rs. 570 Cr, up 28% yoy

- PBT at Rs. 778 Cr, up 33%; positive impact of Rs. 330 Cr. from APTEL order in favor of MEGPTCL SPV in Transmission business received in Q1FY21

- EPS at Rs. 4.3 vs. 2.2 in H1 FY20; up 94.2% yoy

- Transmission Operational EBITDA at Rs. 1,267 Cr with a margin of 92% compared to Rs. 1,238 Cr in H1FY20

- Distribution Operational EBITDA at Rs. 804 Cr with margin of 28%

- Consolidated Operational EBITDA(1) at Rs. 2,071 Cr vs. Rs. 2,120 Cr in H1 FY20

- Consolidated Operational Revenue(1) at Rs. 4,272 Cr vs. Rs. 5,446 Cr in H1 FY20

- With announcement of favorable regulatory order in respect of MEGPTCL, ATL Conso will have annual recurring EBITDA benefit of ~Rs.60 Cr

Ahmedabad, November 06, 2020: Adani Transmission Ltd. (“ATL”), a part of the Adani Group, today announced the financial results for the quarter.

Operational Highlights:

- Strong Transmission system availability at 99.9%

- Distribution ensured more than 99.99% supply reliability despite challenges on ground

- Distribution losses were at 8.51% in H1 FY21 improved significantly from 13.47% in Q1 FY21 on account of billing basis actual meter reading

- Collection efficiency at AEML is back to normal levels and stood at 103.5% in Q2 FY21

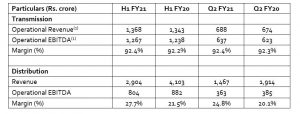

Financial highlights – Transmission and Distribution:

- Transmission business operational revenue in H1 FY21 was Rs. 1,368 Cr with stable operational EBITDA of Rs. 1,267 Cr translating into strong margin of 92.4%

- Distribution segment’s H1 FY21 operational revenue down 29.2% YoY due to lower power demand and shortfall in collections in first quarter of the year; Q2 saw considerable improvement in demand and recorded collection efficiency of 103.5%

- Distribution operational EBITDA at Rs. 804 Cr in H1 FY21 saw 619 bps margin expansion at 27.7% due to stable EBITDA

Financial Highlights – Consolidated:

- Consolidated operational revenue was lower at Rs. 4,272 Cr in H1 FY21 mainly due to lower revenue contribution from Distribution business in first quarter led by lower power consumption in Commercial and Industrial segment and shortfall in collections. Q2 saw considerable improvement in both demand and collections

- Consolidated operational EBITDA at Rs. 2,071 Cr in H1 FY21 posted solid EBITDA margin of 48.5%, an expansion of 956 bps in margin on account of stable EBITDA

- Net debt to EBITDA as of H1 FY21 remains unchanged at 4.3x FY20

Other Key Highlights:

- ATL making steady progress on closure of Alipurduar transmission acquisition announced in Q1FY21

- Customer adoption of digital avenues to interface with company increases manifold reaching 73.3% (e-payments as a % of total collection) in H1 FY21 from 47.2% in H1 FY20

- Adani Transmission to complete 1,000 MW line in Mumbai by Dec 2022 under its SPV Kharghar Vikhroli Transmission Limited (KVTL) with resolution on land allocation

Notes:

1) H1 FY21 Operational Revenue and Operational EBITDA doesn’t include one-time positive impact of Rs. 330 Cr. from APTEL order in favor of MEGPTCL SPV of Transmission business

2) Distribution loss and units sold differs slightly from our provisional operational release released on 19th October 2020

3) Cash profit calculated as PAT + Depreciation + Deferred Tax + MTM option loss

4) ASAI: Average Service Availability Index; APTEL: Appellate Tribunal for Electricity

Speaking on the performance of the company, Mr. Gautam Adani, Chairman, Adani Group, said, “There is abundant potential for increased growth in India’s transmission sector in the coming years. We are spearheading our energies and efforts towards providing reliable power supply across the nation. With the government’s core objective of 24×7 Power for all, considering anticipated growth and demand for power in major parts of the country, Adani Transmission Ltd is committed to deliver continuous growth and is helping in strengthening the transmission network across the nation. We are well-positioned to fulfil India’s electricity needs and look forward to delivering long-term sustainable value through our efficient management of electricity networks. Our increasingly sustainable practices will help ensure ESG driven goals, one that will benefit not only key stakeholders but entire nation”

Mr. Anil Sardana, MD & CEO, Adani Transmission Ltd, said, “Adani Transmission has evolved over the past few years. ATL is constantly benchmarking to be the best-in-class and is pursuing focused approach to be world-class integrated utility through development agenda coupled with de-risking of strategic and operational aspects, capital conservation, ensuring high credit quality and forging strategic partnerships for business excellence and high governance standards. ATL is maintaining 24×7 quality power supply despite challenges posed by health and pandemic issues. The journey towards robust ESG framework and practicing culture of safety is integral to its pursuit for enhanced long-term value creation for all stakeholders”

About Adani Transmission

Adani Transmission Limited (ATL) is the transmission and distribution business arm of the Adani Group, one of India’s largest business conglomerates. ATL is the country’s largest private transmission company with a cumulative transmission network of more than 15,400 ckt kms, out of which more than 12,200 ckt kms is operational and more than 3,200 ckt kms is at various stages of construction. ATL also operates a distribution business serving about 3 million+ customers in Mumbai. With India’s energy requirement set to quadruple in coming years, ATL is fully geared to create a strong and reliable power transmission network and work actively towards serving retail customers and achieving ‘Power for All’ by 2022.