Virendra Pandit

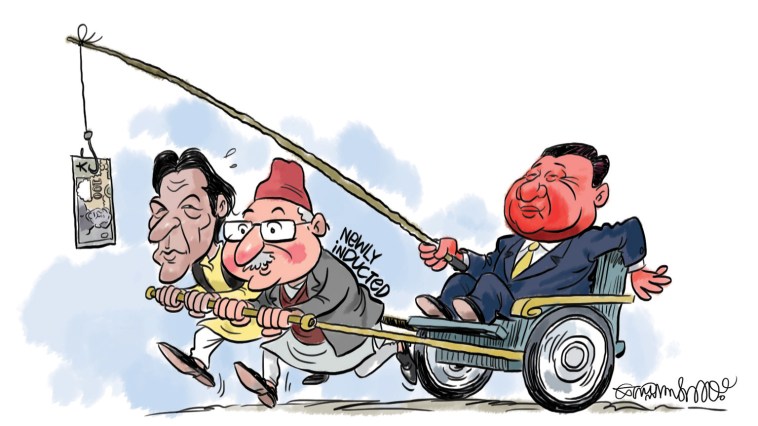

New Delhi: Pakistan will have to meet a dozen stringent conditions in the next six months to be part of the USD 6 billion programs of the International Monetary Fund (IMF) but Islamabad’s economic endurance will continue to hinge on a possible USD 11 billion lifelines from China, media reports said.

With the Chinese economy itself weakening in the wake of the Covid-19 pandemic induced reverses, Beijing is already tightening the belt on the USD 60 billion China-Pakistan Economic Corridor (CPEC) whose only 20 percent projects have been completed since 2013.

But Islamabad is still hopeful.

The South Asian country’s gross external financing needs, which it needs to pay off foreign loans and finance its imports, are to the tune of a whopping USD 27 billion over the next 12 months, according to the IMF.

Most of these financing needs will be met by support from China’s USD 10.8 billion and aid from a few other sources.

That means Pakistan will have to borrow from Peter to pay Paul!

The Washington-based IMF, the international lender, on Thursday, released its staff-level report of the USD 6 billion programs, confirming that the Pakistan government was in the process of increasing electricity prices by Rs 5.65 per unit or 36 percent from now till October, according to a report by The Express Tribune newspaper.

This increase will put an additional burden of Rs 884 billion on the consumers by June 2023, according to the circular debt management plan, which the Cabinet approved last month as part of the actions to meet the IMF conditions.

Additionally, the government will have to impose new taxes equal to 1.1 percent of GDP or around Rs 600 billion in June as part of the IMF condition, the media outlet said.

These conditions are among 11 actions that the government will take by September this year.

They are in addition to the five prior actions that the government took to convince the IMF board to approve its case.

The government is implementing these actions to remain in the USD 6 billion IMF program but, at the same time, the report shows that Pakistan’s external financing needs are still largely met by continued support from its ‘all-weather ally’, China.

These financing needs will be met by support from China’s USD 10.8 billion, the UAE’s USD 2 billion, the World Bank’s USD 2.8 billion, the G-20’s USD 1.8 billion initiative, the Asian Development Bank’s USD 1.1 billion, and the Islamic Development Bank’s USD 1 billion, Pakistan informed the IMF.

The finance ministry told the IMF that key bilateral creditors had maintained their exposure to Pakistan in line with program financing commitments.

However, Saudi Arabia, angry at Pakistan’s growing proximity with Turkey, has already withdrawn the USD 3 billion it had committed. Even the UAE has shown its displeasure and is said to be following the Saudis.

“China has maintained its exposure by renewing and augmenting the CYN (yuan) 30 billion, (about USD 4.6 billion) three-year bilateral currency swap”, the report confirmed.

The newspaper had previously reported that China had increased the size of bilateral currency swap from USD 3 billion to USD 4.5 billion to help Pakistan pay off Saudi loans.

The IMF report read that China had renewed the maturing commercial loans as part of the program financing assurance commitment. Beijing rolled over USD 2.5 billion commercial loans in this fiscal year and also plans to extend USD 4.4 billion in the next fiscal year.

The report stated that China had also provided an additional USD 1 billion deposit in July 2020, raising the State Administration of Foreign Exchange (SAFE) deposits to USD 4 billion.